There’s no doubt that anyone who knows even a very little about the market that it has been pushed to “mature” status. What that means is we’re not going to see any huge swings upward anymore.

But what can drive the market higher? What small or large industries can make a difference?

If you’re a low risk investor, what I’d like for you to do is look at a sector which is somewhat overlooked and discarded…

Why? Because there’s a lot more sexy ideas and investment strategies out there.

But I can tell you something’s brewing… something is getting ready for liftoff and it’s not landing anytime soon.

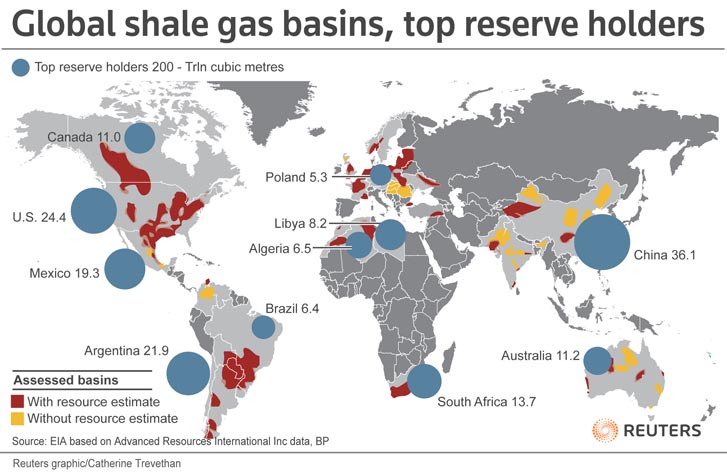

I’m talking about oil shale. Oil shale is the old-new technology in the fossil fuels sector that will continue to grow despite what direction the market moves in.

A market sometime can be affected by a trend and will move as such, but oil shale isn’t a “has potential” kind of sector. It is potential, it’s here, it’s now and it’s not going anywhere.

But it’s not just oil companies that are capitalizing on oil shale; oil shale is catapulting the riches of transport companies, chemical companies, supply companies, pipe companies etc.

Oil Shale is taking literally no name places around this country and turning them into new aged economic paradises where jobs flourish and micro economies emerge. Piggybacking on all of this are the investors of the oil shale companies and the sub sectors that are involved.

Don’t plan on making 100% in 24 hours, but plan on a steady and sustained growth of your portfolio if oil shale is in it. The reality is, the market can fizzle, it can run; however oil shale is a profit center all by itself and disregards what Wall Street does.

I like Eog Resources (EOG). The company, while priced high, is not expensive given what they will become in the future.

EOG explores for, develops, produces, and markets crude oil and natural gas. As of December 31, 2013, it had total estimated net proved reserves of 2,119 million barrels of oil equivalent of which 901 million barrels (MMBbl) were crude oil and condensate reserves, and 377 MMBbl were natural gas liquids reserves; and 5,045 billion cubic feet were natural gas reserves. The company operates primarily in the United States, Canada, the Republic of Trinidad and Tobago, the United Kingdom, the People’s Republic of China, and the Argentine Republic.

With its market cap of 53 billion and its $4 EPS, this is one hell of a whale.

My recommendation: Get in and hold.

===================

“Take This $520 Worth of Free Research and

Multiply It 10 Times Over… On Me!”

Yes, you read that right…

Not only am I giving you $520 worth of my most in-depth profitable research for FREE, but I’m guaranteeing you, it’ll be worth no less than $5,200 within the next 12 months.

By Tim Fields